War in Ukraine: what explains the calm in global stock markets?

The west’s economic warfare versus Russia has been spectacular. Commodity marketplaces are chaotic, stoking previously uncomfortably significant inflation, and world wide economic progress forecasts have been marked down as a end result. Several companies confront big hits from their exits from Russia.

Nonetheless quite a few buyers and analysts have been astonished at the remarkably modest fallout for the global financial technique, and the lack of broader, significant reverberations so much. Following to begin with deepening the global stock industry promote-off, the MSCI All-Region Globe Index has now jumped back higher than its prewar stage, and the Vix volatility index — a proxy for how significantly anxiety there is in marketplaces — has slipped below its very long-term average, indicating a drop in stress.

“I’m shocked at how resilient marketplaces have been,” suggests Robert Michele, the main financial commitment officer of JPMorgan Asset Administration, the US bank’s $3tn expenditure arm. “I’ve been performing this for about 40 years and I really do not at any time bear in mind a time when you have had a shock of this magnitude without generating systemic stress somewhere.”

Nevertheless, some gurus worry that the disaster could nonetheless create some unpleasant surprises, with the monetary ramifications nevertheless to be thoroughly felt. Additionally, there are several other components rattling the money technique at the instant: from soaring inflation, mounting desire premiums, beneath force engineering shares, credit card debt challenges in the creating world and the lingering coronavirus — all of which could interact with each individual other in risky and unpredictable approaches to produce unanticipated issues.

“It’s a tiny surprising that very little has took place so far, but it’s early days,” claims Richard Berner, the to start with director of the US Treasury’s Office environment of Fiscal Study, established up after the 2008 disaster to keep an eye on the environment for systemic risks. “There might nevertheless be vulnerabilities lurking that aren’t right away obvious, and we will not know their character until shocks expose them. Regrettably, that’s sometimes how it is effective.”

In truth, Andrew Bailey, the Bank of England’s governor, highlighted in a speech this 7 days how the nexus of commodity and fiscal current market stresses could result in problems. “We and other central banks . . . are seeing these spots pretty carefully and pretty carefully,” he claimed. “The bottom line is we cannot acquire resilience in that portion of the market for granted.”

‘Premature to declare victory’

Economic marketplaces are what researchers get in touch with a complicated adaptive technique, like our planet’s weather, an ant colony or the human physique, in which a multitude of independent elements can interact in sudden means. That can direct to collective behaviour that is challenging to predict from observing each and every issue independently.

Advanced adaptive units are inherently tough to realize. They can also be both of those impressively resilient and cataclysmically fragile, typically dynamically adapting to setbacks but occasionally succumbing to a harmful mixture of seemingly minor unbiased failures.

The large 2003 North American strength blackout happened simply because of overgrown trees touching some electric power-strains in Ohio, which was then compounded by a application bug and human error. A lot more tragically, the 2014 sinking of the South Korean ferry MV Sewol was brought on by way too small ballast water, too significantly cargo and a difficult switch, and led to the deaths of 304 people today.

This is why Carmen Reinhart, the Entire world Bank’s main economist and a main scholar on monetary crises, warns that “contagion performs in mysterious ways”. Though the monetary technique has therefore considerably only suffered minor “spillovers” alternatively than what she phrases “fast and furious contagion”, Reinhart remains anxious that the ripple effects from Russia’s invasion of Ukraine could be massive.

“Do not undervalue the cumulative toll of spillovers just mainly because they do not have headline drama,” she says.

Two weeks in the past Russia dodged a sovereign debt default, unexpectedly handing extra than $117mn in curiosity payments to overseas lenders irrespective of the draconian sanctions imposed on the region. However couple of anticipate Moscow to remain present-day on its liabilities for extensive.

The future massive exam will occur on April 4, when a $2bn bond — held both of those by domestic and international investors — comes thanks for reimbursement. Regardless, immediately after May perhaps 25 the US sanctions routine tightens further more, prohibiting any US entities from acquiring or transferring any income to or from the Russian condition, creating a default significantly much more probably.

“Russia’s possibility of default and potential for trader losses continues to be quite high specified the marked deterioration we have seen in the government’s capability and willingness to fulfill its debt obligations in the latest weeks,” Moody’s, the score agency, warned in a report past week.

Russia’s last default in 1998 hammered quite a few international banking companies, induced the collapse of the mammoth hedge fund LTCM and led to a string of debacles that still left the world wide monetary technique reeling. Could possibly the planet be facing a painful sequel? Perhaps, but it is unlikely to be activated basically by Russia defaulting on its sovereign credit card debt, analysts say. In relative phrases the international publicity to Russia nowadays is a fraction of what it was in 1998, when many hedge funds and banking companies experienced loaded up on Moscow’s bonds.

“For some thing to develop issues for a sophisticated procedure, it has to be built-in into it. Russia just isn’t that built-in into the world-wide money process,” states Richard Bookstaber, a veteran danger management skilled who was Salomon Brothers’ main possibility officer again in 1998. “Yes, it is 1 more pressure to the technique, but can it do one thing like LTCM nowadays? I really do not assume so.”

Ahead of the Ukraine invasion, international buyers held about $20bn of Russia’s dollar-denominated credit card debt, and rouble-denominated bonds really worth $37bn, in accordance to the country’s central financial institution. Sizeable, but not enough to constitute a major shock even if there is a default. Also, for investors trapped in Russian securities, these kinds of as BlackRock and Pimco, the hurt has presently been accomplished.

Western sanctions have blasted the country’s money markets, which usually means quite a few traders have in essence penned off their holdings of Russian personal debt. No a single will as a result be amazed if Moscow’s payments get snarled up by the draconian sanctions routine, even if Russia continues to be ready to support its debts.

“Whatever comes about, this is not wherever the action will be having place,” states Polina Kurdyavko, head of rising market personal debt at BlueBay Asset Administration. “This has been priced in currently.”

Nor do intercontinental financial institutions appear significantly susceptible. The IMF’s managing director Kristalina Georgieva has approximated that the total publicity of foreign creditors to Russia quantities to roughly $120bn, which, while not insignificant, was “not systemically relevant”, she informed CBS in March.

Michele at JPMorgan Asset Administration agrees. “We put in that initial weekend going via all the banking institutions and making an attempt to find where by the incident would be. We just could not come across any, regardless of hunting and on the lookout and wanting,” he claims. “Because of the global financial crisis, and the regulatory framework that was set in position, banking companies are loaded with reserves, buffers and money.”

A repeat of the LTCM debacle is also inconceivable. Some hedge cash are definitely nursing painful hits, but the amount of financial debt and derivatives publicity that LTCM had utilised to amplify its bets is unheard of these days. The aggregate web leverage of hedge cash was 48 for each cent at the start off of 2022, and the gross industry publicity was about 260 for each cent, according to Goldman Sachs info. LTCM’s gross sector exposure in 1998 was 25 instances larger sized than its cash.

“The diploma of leverage is nowhere in close proximity to where by it was at the time of LTCM,” states Bookstaber, co-founder of Cloth, a chance administration consultancy. “That’s not to say that there are not dangers, but I do not feel Russia is enough” for a systemic crisis.

Fears above another economic disaster have been a fixture ever due to the fact the very last a person. Just about every month for over a 10 years, Bank of The usa has surveyed investor shoppers on what they look at the greatest chance confronting marketplaces. It tends to reflect whichever is hitting the headlines at the time, from the eurozone financial debt crisis to China’s slowing financial state, central lender faults or US presidential elections, trade wars and pandemics.

Despite the fact that a lot of of these pitfalls have manifested, it is amazing how several prompted any major complications. The world inventory market place has returned 168 per cent due to the fact Lender of America’s 1st survey in July 2011, when concerns above the eurozone’s solvency spooked marketplaces.

Nevertheless, some fret that a Russian default — if it does materialize — could continue to prove destabilising, even if it is now greatly expected. “The authentic pinch is what transpires at default time, and that has not kicked in but. So it is premature to declare victory,” Reinhart claims. “The drama is not over. We went by means of the to start with act, but there are numerous much more acts to come.”

Challenges inside of the genuine overall economy

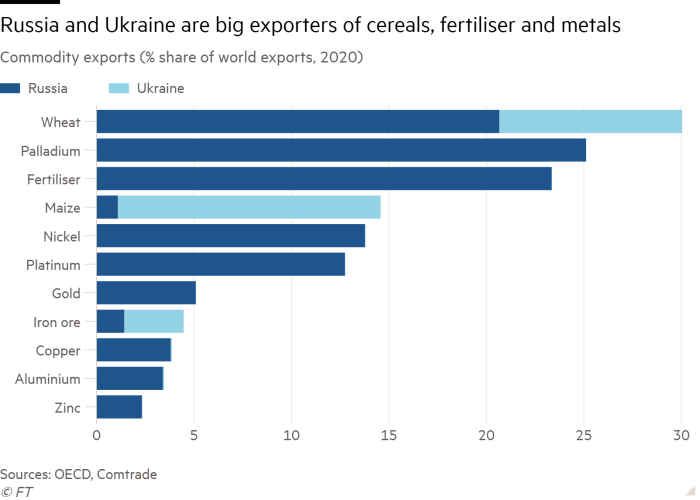

Stresses in the commodities markets are illustrative of why several continue being careful. Russia may well not be systemically significant to the fiscal technique, but it is arguably so for the world of organic means.

The prospect of diminished energy and commodity supplies has despatched costs of oil, foodstuffs and metals soaring. That has strike major investing organizations this kind of as Glencore, Trafigura and Vitol, who assist go the actual physical property via the world’s terminals and storage services and count on derivatives contracts to hedge by themselves against price ranges transferring unfavourably in between the time of order and supply.

To shield by themselves from default, clearing houses and brokers that act as investing intermediaries have elevated the amount of margin, or cash collateral, their shoppers need to have to offer to underpin these trades. The more volatility, the extra margin traders have to submit.

Margin is returned to traders when the commodities are shipped, but investing businesses have faced speedy demands to locate billions of bucks, putting a extreme strain on their liquidity. The bond costs of many of the industry’s major businesses have occur under tension as lenders worry incidents might materialize. The European industry’s trade system has even asked central banking institutions for “time-constrained emergency liquidity support” to help handle “intolerable cash-liquidity pressure”.

This is an additional reminder that banking institutions are not the only critical corner of the fiscal program, states Berner. “We addressed a good deal of the vulnerabilities in the banking sector right after 2008, but we failed to deal in the non-bank monetary sector, generally named ‘shadow banking’,” he states. But the NYU finance professor is sceptical that central banks must ride to the rescue of any battling commodity trading organizations. “Expanding with out restrict the job of central banking companies is one thing we should to seem at incredibly meticulously,” Berner adds.

There are several approaches that tumultuous commodity markets could reverberate in dangerous techniques, from triggering meals crises that result in political upheaval in the acquiring entire world to putting tension on central clearing houses, utility-like intermediaries for the derivatives investing method that ended up handed an increased role as threat buffers in the wake of the 2008 economical disaster.

On the other hand, the most probably way that Russia could spark a wider conflagration is just the uncomfortable timing of the crisis and the impact on central banking institutions. Rather than the regular money channels of a crisis, this contagion operates by means of the real financial system.

The selling price of every thing from semiconductors and infant method to grains and metal experienced presently skyrocketed in the wake of the pandemic, forcing central banking institutions to abruptly shift from attempting to encourage economic advancement to combating inflation. The war has now rattled provides of staple assets these as potash, neon gasoline, nickel, maize and wheat from Russia and Ukraine, two of the world’s most significant producers of these commodities, worsening the inflation outlook.

Reinhart details out that the share of superior economies with inflation charges previously mentioned 5 for each cent or bigger has climbed from zero a calendar year in the past to nearly 60 for each cent in February 2022, even in advance of the Russia-Ukraine disruptions filter completely by way of. That could power central banks to elevate interest premiums far extra aggressively than they would like, to steer clear of inflation anticipations from getting to be completely unanchored from central bank targets, she argues.

“The pressure that the Ukraine-Russia crisis brings to bear at a time in which inflation was by now about signifies that the uphill battle is even extra uphill,” Reinhart says. “Relative to the conventional of [central bank] lodging we have viewed considering that 2008, even tweaking is tightening. And we will want to more than tweak financial policy.”

In other words and phrases, Russia may well convert out to be an inflationary snowball that results in an avalanche of intense desire price rises, and in turn requires the economical method — complacent that monetary plan will keep on being simple permanently — by surprise.

Bookstaber is amid these unnerved by the risk.

“Systemic risks are hardly ever a little something delicate, even if they are under-appreciated. It is generally the stuff we know about, but dismissed,” he states. “Everything we’ve observed in latest historical past is an simple monetary routine. Individuals betting on that continuing may well be in for a horrible shock.”