Stock-market investors laugh off yield curve’s recession warning — for now. Here’s why.

Blink and you missed it, but the yield on the 2-12 months Treasury note traded briefly higher than the yield on the 10-12 months notice Tuesday afternoon, temporarily inverting the yield curve and triggering economic downturn warning bells.

Facts displays that it hasn’t paid out in the past to abandon shares the moment the Treasury yield curve turns upside down, with short time period yields larger than longer phrase yields.

Not a great timing tool

“While a very good indicator of long run financial woes, an inverted generate curve has not been a extremely fantastic timing device for fairness traders,” wrote Brian Levitt, world-wide market strategist at Invesco in a March 24 notice.

See: A crucial component of the Treasury produce curve has ultimately inverted, location off recession warning — here’s what buyers have to have to know

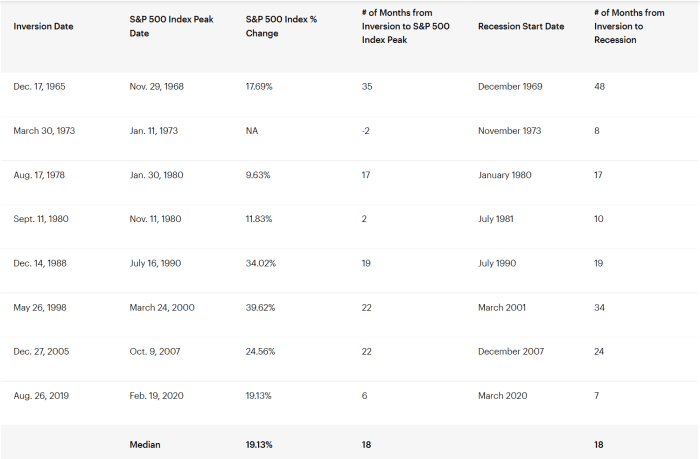

“For case in point, buyers who marketed when the yield curve 1st inverted on Dec. 14, 1988, missed a subsequent 34% obtain in the S&P 500 index,” Levitt wrote. “Those who sold when it occurred all over again on May well 26, 1998, skipped out on 39% further upside to the sector,” he stated. “In simple fact, the median return of the S&P 500 index from the date in just about every cycle when the generate curve inverts to the marketplace peak is 19%.” (See desk below.)

Invesco

Investors absolutely didn’t head for the hills Tuesday. U.S. stocks finished with powerful gains, developing on a bounce from early March lows and even propelling the S&P 500

SPX,

to an exit from the current market correction it entered in February. The Dow Jones Industrial Ordinary

DJIA,

jumped 338 details, or 1%, though the Nasdaq Composite

COMP,

sophisticated 1.8%.

Browse: S&P 500 exits correction: Here’s what background claims comes about next to U.S. inventory-sector benchmark

Inversions and what they suggest

Typically the generate curve, a line that steps the yields across all maturities, slopes upward presented the time worth of cash. An inversion of the curve signals that buyers assume for a longer period time period costs to be down below in close proximity to-phrase rates, a phenomenon broadly taken as a signal of a prospective economic downturn.

But there’s a lag there, far too. Levitt pointed out that the info, likely back again to 1965, clearly show the median size of time between an inversion and a economic downturn has been 18 months — matching the median stretch among the onset of an inversion and an S&P 500 peak.

Additionally, scientists have argued that a persistent inversion is needed to send out a sign, some thing that hasn’t happened yet, but stays extensively envisioned.

Which curve?

An inversion of the 2-yr

TMUBMUSD02Y,

/10-12 months

TMUBMUSD10Y,

measure of the yield curve has preceded all 6 recessions given that 1978, with just a single false optimistic, mentioned Ross Mayfield, financial investment tactic analyst at Baird, in a Monday take note.

But the 3-month/10-yr spread is viewed as even, if only a bit, more trusted and has been more well known amongst lecturers, observed scientists at the San Francisco Fed. And Fed Chairman Jerome Powell before this thirty day period expressed a preference for a more brief-phrase oriented evaluate that actions 3-month charges compared to anticipations for 3-thirty day period rates 18 months in the future.

The 3-month/10-calendar year spread, in the meantime, is “far from inverted,” Mayfield famous.

See: Stock-market traders ought to observe this element of the yield curve for the ‘best leading indicator of trouble ahead’

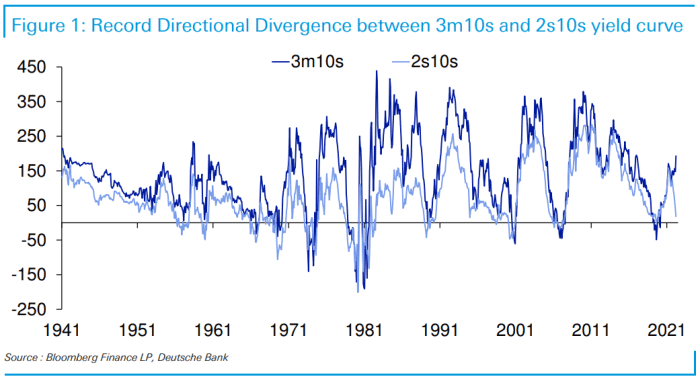

In truth, the divergence involving the two intently adopted measures of the curve has been a head scratcher for some market place watchers.

“The exceptional detail is that the two have often gone hand in hand directionally right up until all over December 2021 when 3m/10s began to steepen as 2s/10s collapsed,” said Jim Reid, strategist at Deutsche Bank, in a Tuesday be aware (see chart down below).

Deutsche Financial institution

“There has hardly ever been these kinds of a directional divergence potentially for the reason that the Fed [has] under no circumstances been as powering the ‘curve’ as they are currently,” Reid stated. “If marketplace pricing is proper, they will quickly catch up in excess of the next calendar year so it’s achievable that in 12 months’ time” the 3-month/10-year evaluate will be flat as quick-phrase rates increase as the Fed hikes its benchmark policy premiums.

The takeaway, Mayfield wrote, is that the generate curve remains a potent indicator and is at the extremely minimum signaling a cooling economic system.

“Volatility should keep on being heightened and the bar for investing good results is elevated. But in the conclude, we believe it is value using the time to digest the greater photo and not depend on any solitary indicator,” he mentioned.

In 1 Chart: ‘The dam finally broke’: 10-12 months Treasury yields spike to breach major of downward trend channel found because mid-1980s