Soaring mortgage rates will pile pressure on property market

A ten years-lengthy social gathering for homeowners is coming to an conclude. The value of servicing home loans in the United kingdom, Europe and the US has spiralled at the same time as disposable incomes have been squeezed, and predictions of a downturn or even a residence value crash are now frequent.

Very last 7 days, Knight Frank forecast that house price ranges in London would slide 10 for every cent around the following two years — a hugely unconventional go for an estate company, which provides to unbiased assessment and lender predictions of falls at minimum that throughout the British isles.

How could housing marketplaces, which have felt nothing at all but price advancement for a ten years, tip into crash territory?

The economical crisis in 2008 provided a chastening lesson in the dangers of borrowing excessively towards housing.

Back then about one in 7 home loans ended up remarkably leveraged with financial loan to value ratios equivalent to, or increased than, 90 for each cent. In the decades since, financial institutions have tightened their lending conditions with only 4 for each cent acquiring the identical borrowing concentrations.

Today’s borrowers ought to elevate relatively substantial deposits and demonstrate they can face up to interest level rises. Reckless lending has mostly been kept in test, cutting down the risk of owners slipping into destructive equity.

The other important characteristic of the past ten years has been rock-bottom fascination rates — making it possible for potential buyers to get on significant home loans at minimal monthly costs.

In switch, any individual in a position to establish up a deposit could find the money for a pricier home — betting on repaying it as extended as charges remained reduced and the home finance loan term was extensive sufficient. Lower rates have in effect created bigger residences cost-effective, driving up property rates in return and crowding out those people unable to elevate cash for a deposit or tap the “bank of mum and dad”.

But prices have spiked higher this calendar year — with the Federal Reserve raising the foundation level from .25 per cent to 3.25 for each cent and the Lender of England and ECB next suit — and markets are expecting they will proceed to rise sharply into subsequent yr as central banks try to include runaway inflation.

All of a sudden, that affordability photo has improved radically.

“Only 2-3 months ago we ended up stating interest costs [in the UK] of up to 3 for each cent would be a obstacle, offered affordability. Marketplaces are now anticipating home loan fees heading up to all over 6 for each cent,” said Noble Francis, economics director of the Development Products and solutions Affiliation.

Soaring curiosity fees have experienced an quick influence. Home finance loan creditors in the Uk rushed to pull solutions just after chancellor Kwasi Kwarteng’s tax-cutting “mini” Funds past month drove up anticipations of a level rise.

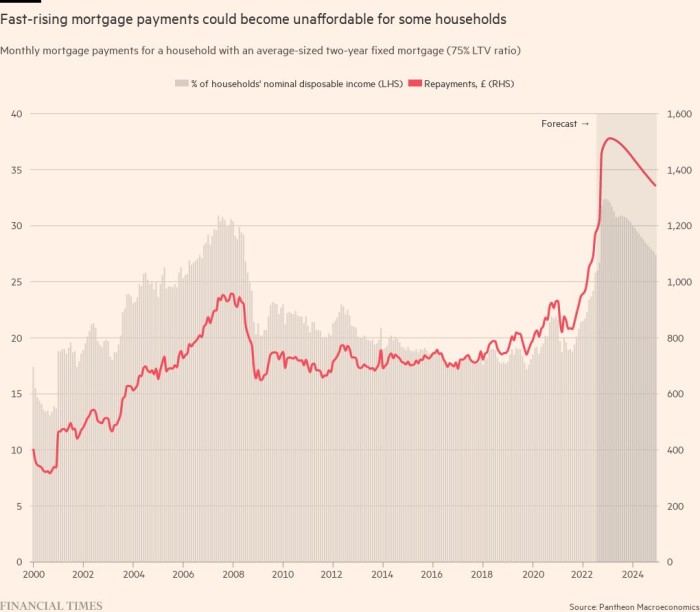

Everyone obtaining a property nowadays in the Uk will deal with significantly increased house loan borrowing prices as a consequence. Mortgage loan payments, as proportion of profits for first time buyers, are roughly 17 per cent on average, according to facts from consultancy BuiltPlace.

On the other hand, it is really not just people at the commence of home ownership. There is also an influence that will be felt additional progressively. Each month, tens or hundreds of thousands of property owners in the Uk roll off fixed-phrase specials and have to remortgage. When they do they will encounter costs that are significantly higher than what they presently shell out — and some may be pushed to sell.

“In a period of time of time wherever the greater part of men and women are very likely to endure actual wage falls, it’s a perfect storm for homeowners who have acquired in the final 10 yrs and are not employed to higher mortgage fees,” claimed Francis.

There are signals that higher borrowing costs are currently impacting demand for new residences, with house portal Rightmove reporting that exercise from prospective consumers was down very last 7 days on latest averages — albeit modestly.

Ebbing demand from customers will decrease transactions in the United kingdom from an currently-low foundation by historic criteria. Reduced need normally puts a lid on household price tag advancement and a paucity of transactions signifies info can be skewed by a limited selection of deals.

“Clearly what you are likely to see is a a great deal lessen transactions housing market place dominated by desires-primarily based movers and the money wealthy,” claimed Lucian Cook dinner, head of United kingdom household study at estate agent Savills.

In the US, there is presently proof of heat coming out of the revenue market, with transaction volumes slipping across numerous massive towns.

FT investigation of facts delivered by actual estate corporation Zillow to the conclude of July 2022, displays that month-on-month expansion in household revenue in the US has fallen from 4.4 for each cent at the height of write-up-pandemic rebound for the duration of the center of 2021, to a small of -2.2 for every cent on a 12-thirty day period rolling foundation.

Outside of necessity — loss of life, personal debt and divorce are routinely cited as the a few greatest motorists of profits by estate agents — there is minimal incentive to provide in a down-industry. But larger costs for remortgaging could put strain on some property owners to trade at a discount, dragging down average prices that are established by recorded transactions.

Dwindling sales quantities, stretched affordability and force on remortgaging householders could precipitate distressing selling price corrections in the United kingdom, US and in other places.

In the aftermath of Kwarteng’s spending budget, multiple forecasts now have average British isles property rates falling much more than 10 per cent on a nominal basis above the upcoming two several years. Thanks to the operate-up in prices during the pandemic, even a slide that steep would only thrust selling prices back to degrees recorded in May possibly 2021.

But the repercussions could however be dire, specifically for latest prospective buyers. Since inflation is operating at this sort of substantial levels in the US and Europe, a 10 slide in nominal selling prices would characterize a true phrases fall of closer to 25 for each cent — a bigger drop than the agonizing correction that adopted the monetary disaster.

Facts visualisation by Steven Bernard and Patrick Mathurin