Why the analyst who called summer stock-market bounce sees more S&P 500 upside

Stifel’s Main Fairness Strategist Barry Bannister ought to be taking a victory lap correct now.

Since Bannister first unveiled his connect with for a “summer rally” — a get in touch with that landed shortly following shares strike their “peak hawkishness”-impressed bottom previous thirty day period — the S&P 500

SPX,

has state-of-the-art extra than 5%. And according to Bannister, the rally could have at least another 5% — or additional — to go over the coming months.

Bannister, who contends that shares have entered a secular bear current market, expects the bounce to be led by cyclical development stocks, like the tech shares that led the market lower earlier this year. For what it’s well worth, the Nasdaq Composite

COMP,

is up far more than 7% in excess of the previous month, when compared with a 6% get for the S&P 500.

Bannister reiterated his simply call in a take note to customers on Monday, arguing that investors have turn into extra bearish than even they probably comprehend, and that the near-expression fundamentals for equally corporate profits and the underlying U.S. financial state propose the rebound could have more home to run.

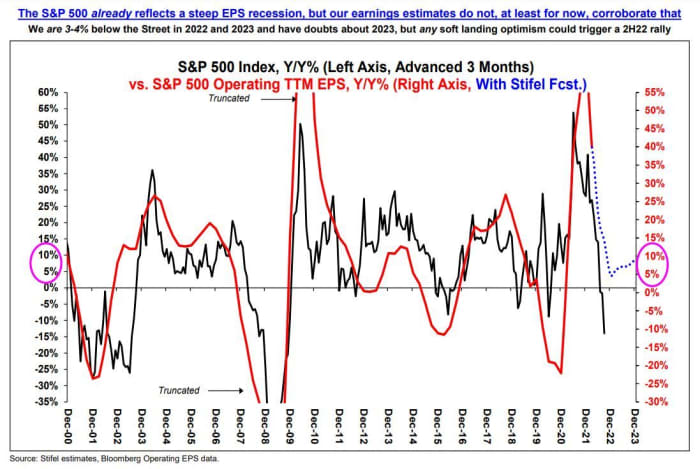

Shares have by now surrendered all of their publish-COVID froth, and on a valuation basis, they are remaining valued as if a company earnings recession has now arrived — but it hasn’t.

What’s additional, Stifel does not see a economic downturn arriving in advance of the conclude of the year. This is immediately becoming a contrarian view on Wall Avenue, as quite a few of the most significant economical supermarkets in the U.S. are altering their very own expectations to accommodate what quite a few see as the increasing risk that a U.S. recession is either imminent, or possibly has currently arrived.

Late previous 7 days, Bank of America’s economists said that they now hope “a moderate recession” commencing in the U.S. in advance of the finish of the yr, even though the bank’s equity strategists minimize their end-of-calendar year forecasts for shares.

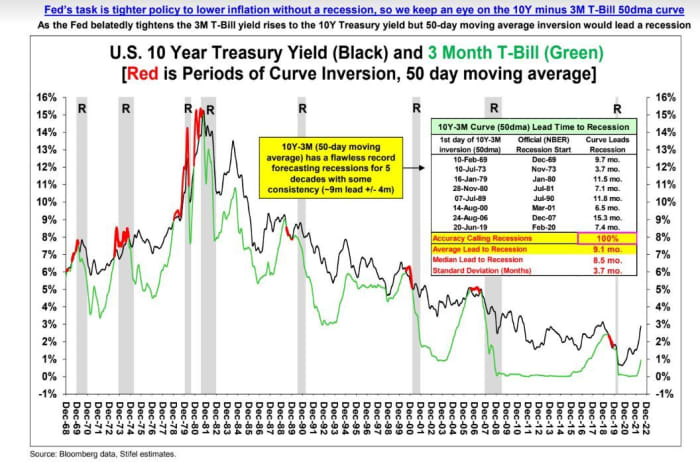

But Stifel does not see reputable indicators of a economic downturn in the financial information, or in the marketplaces, even right after previous week’s inversion of the Treasury yield curve.

In accordance to Stifel, the inversion of the 2-yr

TMUBMUSD02Y,

as opposed to 10-12 months evaluate of the produce curve — noticed as a traditionally reliable recession warning flag — isn’t enough. As a substitute, the 50-working day shifting normal of the three-thirty day period Treasury monthly bill generate

TMUBMUSD03M,

ought to eclipse the 50-day moving average of the 10-calendar year notice produce

TMUBMUSD10Y,

for an prolonged period just before it will become a certainly responsible indicator of a economic downturn, he argued.

Resource: Stifel

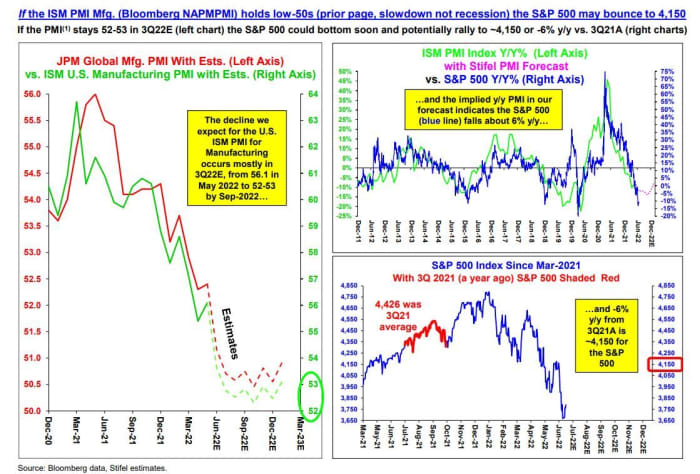

As for the economic data, Bannister and his crew will be trying to keep a near eye on the Institute for Offer Management’s manufacturing index, which they see as an essential recession harbinger, alongside with corporate credit spreads.

Resource: Stifel

Component of Stifel’s anticipations for a strong bear-industry rally is the notion that corporate earnings anticipations have grown far too downcast. Stifel does not be expecting a corporate earnings recession — that is, two quarters of contracting company profits — until eventually future year.

Supply: Stifel

As for inflation, the sector has by now obtained plenty of very good information in the type of oil costs, which have fallen by far more than 10% over the earlier month. As consumer’s inflation anticipations proceed to average, Stifel expects core inflation, as calculated by the personalized-use-expenses value index, will slow to “the Fed’s look at of 2.7% by 2023.”

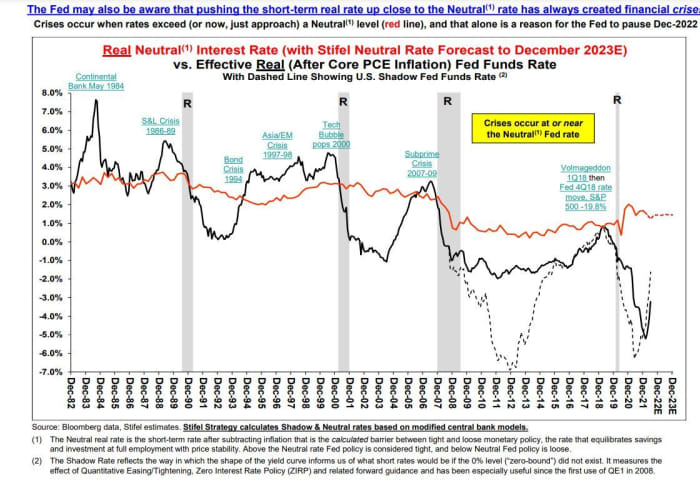

But if the Fed wants a different purpose to contemplate a crack from the relentless tempo of price hikes that commenced back in March, there is also this: the chart underneath — seemingly just one of Bannister’s favorites — purports to present that the threat of economic crises rises as the Fed’s benchmark fee gets closer to the genuine neutral fee — a evaluate of the fee where by an financial state is finely balanced for both highest employment and minimal value pressures.

Resource: Stifel

So far, at the very least, marketplaces seem to be in the center of a tough bear-market place rally. Shares finished larger on Friday after one particular of the market’s most effective performances in a few months. And on Monday, stocks appeared set to increase to their gains, with the S&P 500 up .8% at 3,896 shortly immediately after the open, while the Dow Jones Industrial Common

DJIA,

remained up 175 factors, or .6%.