What home prices will look like in 2023, according to Zillow’s revised downward forecast

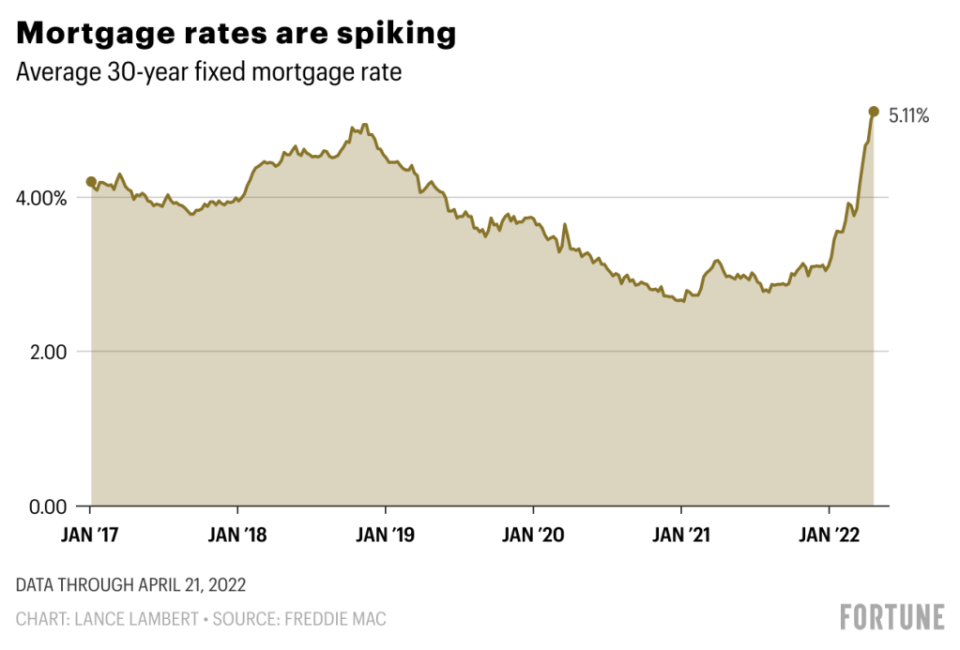

There is no doubt about it: Soaring house loan charges are an economic shock to the U.S. housing current market. Above the past thirty day period by itself, the common 30-calendar year fixed home finance loan amount has spiked from 3.11% to 5.11%. It truly is both pricing out some stretched homebuyers and causing some would-be borrowers to get rid of their mortgage loan eligibility.

The swift go up in house loan prices also has analysis companies re-gearing their housing forecast styles.

Heading into 2022, actual estate study firms presumed the Federal Reserve would place upward strain on charges—but not like this. On the calendar year, the House loan Bankers Association forecasted the typical 30-12 months preset price would climb to 4%, while Fannie Mae forecasted a 3.3% mortgage amount by year’s close. We blew earlier those people estimates weeks ago.

Now, serious estate researchers are dialing down their residence price tag forecasts. On Wednesday, Zillow researchers released a revised forecast, predicting that U.S. residence prices would increase 14.9% amongst March 2022 and March 2023. Which is down 2.9 proportion factors from final month, when Zillow mentioned home price ranges would shoot up 17.8% in excess of the coming calendar year.

“Driving the downwardly revised forecast are affordability headwinds that have strengthened more quickly than anticipated, mainly thanks to sharp boosts in property finance loan premiums,” wrote the Zillow scientists. “More challenges to the outlook as properly: Stock ranges continue being near file lows, but have the potential to recover more rapidly than predicted, which could reduced long run value and income quantity projections.”

The truth Zillow has cut its forecast should not arrive as a shock. Soon after all, this swift move up in premiums is building a significant affordability crunch for homebuyers. At a 3.11% fastened mortgage price in December, a borrower would owe a principal and curiosity payment of $2,138 on a $500,000 home loan. That payment would spike to $2,718 if taken out at a 5.11% fee. Over the program of the 30-yr bank loan, that’s an supplemental $208,800.

If Zillow is suitable and house charges do increase one more 14.9% more than the coming 12 months, it’d mark another traditionally powerful year for property selling price development. About the previous 12 months, dwelling prices are up a staggering 19.2%. Just about every of individuals figures are outliers in comparison to ordinary annual U.S. property cost progress of 4.6% posted given that 1987.

“Even with the downward revision from previous thirty day period, these figures would represent a remarkably competitive housing sector in the coming 12 months,” writes the Zillow researchers.

But not every person is as bullish as Zillow.

More than the coming yr, CoreLogic predicts that dwelling costs are established to decelerate to a 5% price of advancement. The Property finance loan Bankers Affiliation claims property prices are poised to rise 4.8% in excess of the coming 12 months, while Fannie Mae predicts household selling prices will rise 11.2% this 12 months, and 4.2% in 2023.

Of training course, you can find a prospect they’re all erroneous. The Federal Reserve Bank of Dallas has now identified signals that U.S. household value development is bigger than underlying financial fundamentals would thrust it up. The title of the Dallas Fed paper is blunt: “True-time industry monitoring finds indicators of brewing U.S. housing bubble.”

“Our proof points to abnormal U.S. housing sector conduct for the very first time given that the growth of the early 2000s. Good reasons for problem are crystal clear in particular economic indicators…prices surface progressively out of move with fundamentals,” wrote the Dallas Fed scientists.

While CoreLogic says a housing market place correction is unlikely over the coming yr, the research company does say most housing markets across the nation are overpriced. The firm calculated a marketplace chance evaluation for just about 400 metropolitan statistical places. The locating? CoreLogic deems 65% of U.S. regional housing marketplaces to be “overvalued.”

The two homebuyers and dwelling sellers alike may want to acquire housing forecasts with a grain of salt. Glimpse no more than the housing forecasts published during the COVID-19 recession. In the spring of 2020, both Zillow and CoreLogic published economic products predicting that U.S. property costs would fall by spring 2021. That price fall under no circumstances came. As a substitute, the housing market place went on a historic run that continues to currently.

Observe @Newslambert on Twitter to see new housing forecasts as they are introduced.

This tale was initially showcased on Fortune.com