The Importance of Synergistic Capital for Early-Stage Companies

Thoughts expressed by Entrepreneur contributors are their very own.

As I was talking to one particular of my early-phase founders about corporate governance ideas, I understood that what I was sharing with him just isn’t typical know-how. Early-stage founders usually right here “request good capital,” but I understood that founders never actually recognize the entire depth of that assertion or why it is so significant to be strategic when raising money, primarily in the early rounds (pre-seed, seed and Collection A).

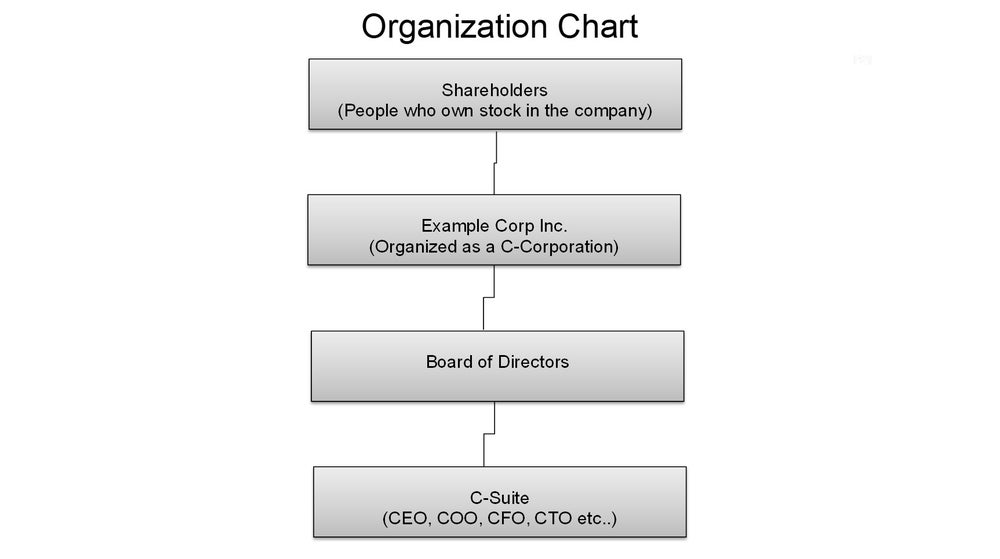

Let us start by switching the phrase “seek out sensible capital” to “look for synergistic cash.” To crystallize the stage of why in search of synergistic money is so important for early-phase founders, I want to go over some vital points of corporate construction and governance, as comprehending this from that lens will better assist you see the worth of the matter. Observe the organizational chart I’ve made underneath:

Graphic Credit history: Fredrick D. Scott, FMVA

It’s not the prettiest org chart I’ve at any time carried out, but it will illustrate this level nicely. The most crucial takeaway from the chart higher than is being familiar with how the hierarchy works. Setting up from the base of the chart and working our way up:

C-suite executives

C-suite executives are regarded “day to day” administrators of the enterprise. They are dependable for overseeing and making sure the corporation and employees are operating within the mission and vision, as outlined by the board of directors (with enter from the C-Suite). They make absolutely sure the company is operating, in all areas, as competently as feasible and hitting the numerous progress metrics set to make sure the corporation is producing far more profits 12 months just after calendar year. Most importantly, you have to comprehend that a firm’s C-suite works to the will and enjoyment of the board of directors. This is a key stage of understanding, and you will see why in a bit.

Relevant: The Essentials of Raising Capital for a Startup

Board of directors

The following stage up in the hierarchy is the board of directors. Their career is to supply oversight of the C-suite, to put into action macro plan, governance paperwork and tempo. Most importantly, their career is to protect shareholder interests by insuring two factors:

A person, that the C-suite is operating in an productive manner and steering the organization in the course that, in the board’s feeling, will direct to the ideal possible likelihood of raising progress, income and financial gain margins yr just after yr.

And two, that there are right guardrails in spot that govern the way the C-suite operates and supply sufficient hazard mitigants in opposition to “irregularities” and/or irrational methods that, in the board’s view, would erode shareholder value. Extra importantly, the board, usually, has the skill to effectuate swift action against a C-suite executive in the party that they sense these action would be in the very best interests of the firm, and by extension, the shareholders.

A excellent illustration of this played out quite publicly at WeWork when the now-previous CEO, Adam Neumann, was ousted from the very company he established by the company’s board of administrators, mainly because (in brief) they felt that his steps were being no lengthier serving the most effective fascination of the enterprise, and by extension, the shareholders.

Shareholders

Let’s choose a deeper glance at them. Shareholders (also known as stockholders) are the owners of a corporation. They buy inventory in the enterprise, and just about every stock they purchase represents a proportion of possession in the organization. How significant or little that percentage of ownership relies upon on how considerably stock the firm challenges and how quite a few of these stocks a human being or another business (both of those of which are regarded investors) purchases. Let’s search at two pretty, incredibly easy examples of this:

Company A has issued 100 shares of stock. An trader decides they want to get 10 shares of Firm A’s stock. That investor now owns 10% of Company A.

Enterprise B has issued 1,000 shares of stock. An trader decides they want to get 10 shares of Business B’s inventory. That investor now owns 1% of Company B.

Be aware that these are, all over again, extremely uncomplicated illustrations, and factors can get fairly a little bit much more elaborate than that when seeking at a firm’s fairness framework. Nevertheless, the intent of these illustrations is to illustrate the issue that shareholders are element-owners of the company.

Associated: Should You Pitch Your Startup to Early-Stage Investors?

The great importance of seeking synergistic funds

With the higher than details founded, let’s analyze why searching for synergistic capital as an early-stage corporation is crucially important. As outlined in the earlier mentioned discussion, it would appear like everybody is performing in direction of the same stop: To make a lot more money for the organization, and in transform, make additional money for the shareholders of the firm. In the best condition, absolutely everyone is aligned completely in that endeavor. On the other hand, factors are almost never great in the authentic earth, especially for early-phase corporations. Whilst the final purpose may be the exact (to make extra funds), there can be a divergence of thoughts amongst senior executives and the board of administrators on the greatest way to go about accomplishing the best aim. This divergence is exactly where issues can start and where failure can ensue for early-phase corporations and/or their founders.

The issues lies in how the the vast majority of early-stage organizations go about increasing cash. Typically, mainly because of the really mother nature of staying a startup business and all the obstructions that appear along with that, founders who are striving to increase funds for their corporations (particularly in the early rounds), are so desperate for cash that they are keen to consider it from any individual who’s prepared to give it.

The challenge with taking this method is that, a large amount of periods, your earliest buyers (specially those people with expertise in early-phase investing) will probable demand that they are provided a board seat as a situation to supplying you capital. The rationale from an investor’s standpoint is that they want to be able to physical exercise oversight on the company — and by extension — the use of the funds they give the enterprise, to make sure that the capital is currently being used correctly and competently.

When a founder understands this actuality, what appears to be like these kinds of a insignificant matter (supplying absent a board seat) isn’t so slight any longer. Remember, the board’s job is to guard shareholders’ pursuits and do what they feel is likely to drive shareholder worth the quickest. Their belief on how that can be done may possibly not align with a founder’s eyesight for the corporation.

Now, a good deal of founders looking through this post will say “Properly I individual most of my firm’s shares so this is a non-issue for me.” That could be legitimate Nowadays, having said that, as you raise far more and additional money, you have to give absent more and much more possession of the business (known as dilution), so in small: The much more you raise, the much less you have. Without proper organizing, it is easy to obtain by yourself, as a founder, in the minority possession posture of the very company you started off.

Couple that with a board of directors that does not thoroughly see eye to eye with the way you are functioning the organization, and you could very easily obtain on your own on the outdoors on the lookout in (indicating fired). Even if you are the chairman of the board, it won’t make any difference, you can however be outvoted by the rest of your board.

Enjoyable reality: Did you know that, according to Roberts Policies of Buy (the gold standard for how to conduct board conferences), the chairman of the board will not even get to vote unless it is to crack a tie?!

This is why trying to find synergistic money is so vital for early-stage founders. You want to make certain that the people today who are investing in you and your business are entirely aligned with you and your vision. You want people who think in you to help you add accretive price to your enterprise by way of working experience, relationships,and time investment into your enhancement as a founder and CEO (and into the advancement of the firm by itself). In my view, everything small of this is a recipe for eventual disaster (try to remember 94% of enterprise cash-backed companies inevitably are unsuccessful).

The ideal probability a founder and their firm have to thrive is by being strategic and intentional in every single element of their business endeavors, and that is specially essential in the component of increasing capital. Founders have to keep in mind that venture funds won’t function with out firms to commit in, so it is critical to remember this point, and increase money as a founder, not as a pauper!

Similar: Raising (Smart) Capital And Why It truly is Not Just About The Dollars