S&P 500 exits correction: What history says happens next to stock-market benchmark

The S&P 500 index exited sector-correction territory Tuesday, a go that has tended to point to in the vicinity of- and medium-time period gains for the U.S. large-cap benchmark in the past.

The S&P 500

SPX,

rose 56.08 factors, or 1.2%, to near at 4,631.60 in Tuesday’s session. The index essential to shut above 4,587.77 to mark a 10% increase from its March 8 close at 4,170.70, which marked the correction small, according to Dow Jones Market place Information. The S&P 500 fell into a market correction on Feb. 22, when it completed far more than 10% beneath its Jan. 3 record near.

A industry correction is described as a tumble of 10% but considerably less than 20% from a recent peak. A decline of 20% or additional marks a bear industry. Under the definition used by Dow Jones Industry Facts, an asset does not exit a correction till it rises 10% from its correction reduced.

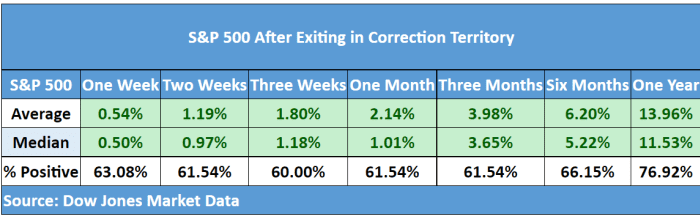

The desk under, which excludes periods when a correction turned into a bear market, maps out how the S&P 500 has tended to accomplish right after exiting:

Dow Jones Industry Data

Centered on info heading again to 1928, the S&P 500 has found a median gain of 11.5% a calendar year after exiting correction, and average acquire of just about 14% — rising virtually 77% of the time. Median and normal returns for shorter phrase time frames were being also constructive.

U.S. shares stumbled early in the new yr as the Federal Reserve signaled it would be extra intense than earlier predicted in elevating fascination charges and normally tightening monetary coverage in response to inflation operating at a practically 40-yr high. The S&P 500 entered correction territory just forward of Russia’s Feb. 24 invasion of Ukraine and set its closing low on March 8.

Stocks have subsequently bounced as the war continued and as the Fed has signaled it will shift promptly and aggressively, with Fed Chairman Jerome Powell opening the doorway to fifty percent share level charge raises in the foreseeable future relatively than quarter-place moves.

Equities rose Tuesday as the 10-calendar year Treasury yield briefly traded below the 2-12 months yield, quickly inverting a evaluate of the yield curve that is considered as a reputable economic downturn indicator, although stocks have tended to hold up in the fast to medium-term wake of past inversions, knowledge display.

The Dow Jones Industrial Ordinary

DJIA,

finished 338.30 factors increased, up 1% on Tuesday, though the Nasdaq Composite

COMP,

which fell into a bear market before this year, jumped 1.8%. Shares missing floor Wednesday, with the Dow and S&P 500 snapping a 4-day winning streak, whilst the Nasdaq drop additional than 1% following again-to-again gains.

Examine: Inventory-market place traders brush off yield curve’s recession warning — for now. Here’s why.