Should You Really Be Investing in the Stock Market Right Now?

The S&P 500 has officially fallen into a bear market place, and some of the most preferred U.S. stocks have now lost 50%, 70%, or even additional from their the latest peaks. This decline arrived swiftly and unexpectedly, and other than electricity, has spared incredibly little of the market place.

It truly is flawlessly organic if you happen to be inquiring, “Really should I even be investing ideal now?” And whilst the answer is typically sure, there is certainly extra to contemplate.

Graphic resource: Getty Pictures.

Must you actually be investing in the inventory market suitable now?

The limited respond to is indeed. With the total marketplace about 20% off its the latest substantial, extensive-time period investors should really completely proceed to incrementally devote in excess of time.

If you seem at 20-yr time durations, the stock marketplace has often ended greater than it commenced. And historically speaking, it’s been a terrific time to devote after the S&P declines by 20%, even if it finishes up declining even extra.

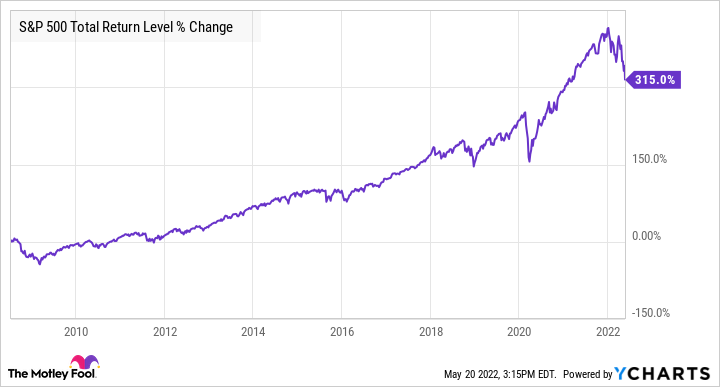

Consider this case in point. The monetary crisis and Terrific Economic downturn of 2007-09 was a person of the worst bear markets in history, with the S&P 500 dropping by as a lot as 55% from its earlier highs by March 2009. But let us say that you made the decision to commit in an S&P 500 index fund when it first entered bear market place territory and dropped 20%, which happened in July 2008.

If you experienced invested $10,000 at that time, you would have witnessed the worth of your investment decline to about $5,500 around the up coming 9 months or so till the industry bottomed. But how would you be performing now?

You may be amazed to understand that even nevertheless the sector fell more immediately after you acquired, your financial investment would be worth additional than $41,500 currently — and which is soon after the modern market slump. That’s an annualized return of almost 11%. As I said, shopping for when the market place has declined by 20% from the highs is a good entry stage for lengthy-expression traders.

A few caveats

As outlined before, the respond to isn’t constantly a resounding “indeed,” in particular when it will come to investing new cash in a turbulent market.

For a single detail, it can be generally a superior notion to hold any cash you are going to have to have in just the following five years out of the stock current market. To be confident, every single bear market in record has appear again to achieve new all-time highs, but the length of time it has taken may differ significantly.

You will find also your very own psychological health to consider into consideration. If placing your challenging-earned revenue to work in a sector behaving like this will make you rest much less soundly and trigger you a lot of tension, it can be a great concept to pause new investments.

Finally, it really is also value contemplating what you happen to be investing in. An expenditure in an S&P 500 index fund is just one thing. An financial commitment in an unprofitable software program-as-a-support business enterprise is a thing else solely. With such a large spectrum of chance in the market, this is absolutely really worth considering. Broad industry index funds and higher-top quality blue-chip providers have historically been fantastic spots to make investments right after a 20% market place plunge.

Last ideas on bear market investing

As a ultimate thought, it truly is crucial to admit that the current market absolutely could go down from below. If inflation receives even bigger, or the U.S. economic system falls into a deeper recession than predicted, we could see a further leg downward.

Nevertheless, just one of the worst faults you can make ideal now is selling stocks (specially if their corporations are accomplishing effectively) into this market place weak point. If you never want to devote new dollars, wonderful, but worry-advertising is just about usually a miscalculation from a extended-term perspective. It is entirely comprehensible to be tempted — following all, it is really typical understanding that the goal of investing is to get reduced and provide substantial, but human mother nature is to flee to basic safety “just before points get any worse.”

Imagine of it this way — if you have been buying in your preferred store, and they declared that anything would abruptly be 30% less expensive, how would you respond? Would you vacant your browsing cart and run out the door? The exact logic applies listed here.