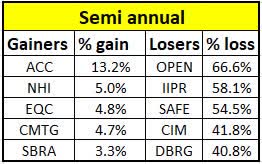

Real Estate slumps 21% in 1H22, focus on mortgage rates

hxdbzxy/iStock via Getty Images

Never seen rising mortgage rates (currently at 5.7% from an average of just 3.2% at 2022 start), rising home prices and a imbalanced home supply and demand have been some characteristics of the U.S. real estate sector in the past 6 months.

In May, new home sales rose 10.7% M/M while Y/Y it saw a growth of 5.9%; existing home sales dropped 3.4% in May marking its straight fourth month of decrease and on Y/Y basis it sees 8.6% dip.

The market generally believes that it will firmly be a sellers market with buyers not having an advantage in the market.

While housing affordability is at the lowest point since the financial crisis, rental market also does not indicate any good signs with occupancy rates at all-time highs and rents on the rise.

A chief economist at CoreLogic forecasts a gradual slowing of home price growth down to single-digit appreciation a year from now while U.S. Bank chief economist sees a strong housing market with low housing inventory, low unemployment, wage growth and a large demographic of buyers entering their peak homebuying years.

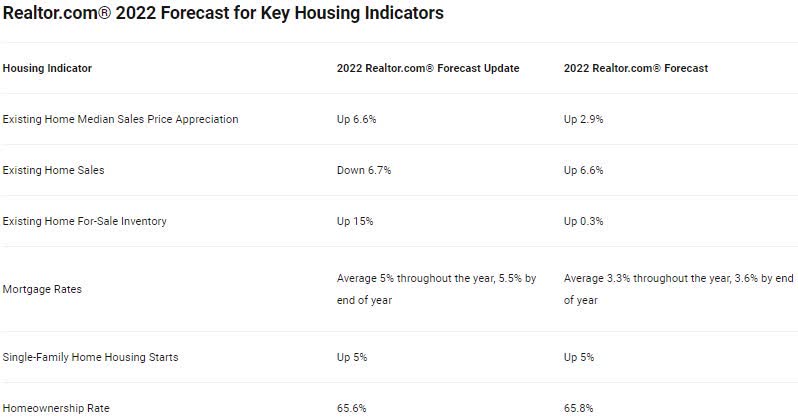

Economists at Realtor.com recently revised their forecasts:

It further added, “While housing costs remain high, pushing home shoppers to make tough choices about their budget priorities, the number of homes for sale is expected to continue to grow, building on the turnaround begun in May.”

Most industry analysts foresee that inventory will remain scarce in 2022 and 2023 with slower price appreciation than it is seen in past two years; rise in listings and high demand are seen continuing.

Freddie Mac expects some cooling in housing demand, forecasting house price growth to slow from 15.9% in 2021 to 6.2% in 2022 and then to 2.5% in 2023; Q4 home sales expected to come in at 7.1M and touch 6.9M in 2022 and increase to 7M in 2023.

Altos Research indicates more than 25% of homes on the market right now have cut their price contrary to how prices have been climbing over the last two years.