Chinese stocks notch steepest monthly loss in 6 years as lockdowns hit growth

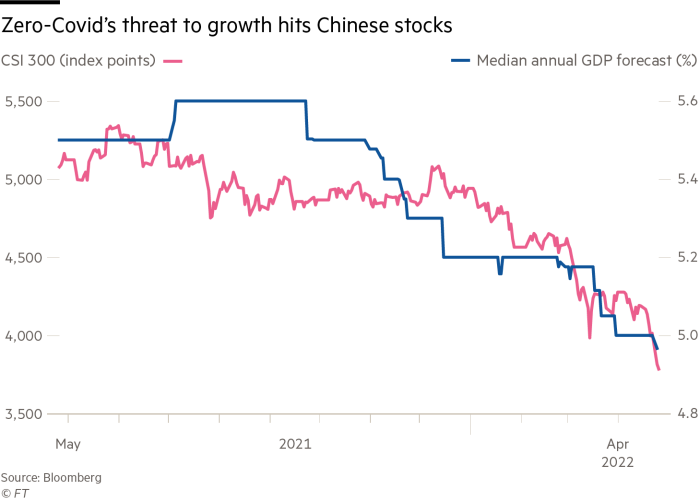

China’s zero-Covid coverage has put its shares on observe for their worst month in 6 a long time, as buyers and analysts warn of deeper losses to arrive on issues that Beijing could skip its growth concentrate on for the very first time.

Souring sentiment has pushed the country’s CSI 300 stock benchmark down 10 for each cent this thirty day period, with traders dumping Chinese equities in the face of harsh lockdowns in metropolitan areas including Shanghai, the country’s premier port and monetary centre. With the chance of a lockdown in Beijing looming, more traders are stressing the worst may lie forward.

“Global marketplaces have been participating in catch-up in recognising the intense consequences of China’s zero-Covid technique,” mentioned Ting Lu, an analyst at Nomura, which not long ago slashed its China development estimate to 3.9 for each cent.

China is aiming for annual growth of “about 5.5 per cent” this year. But, with officials battling to rein in various Covid outbreaks, economists have been pressured in excess of the earlier 7 days to slash their predictions to ranges the moment reserved for worst-situation situations, pushing down the median forecast amid economic establishments polled by Bloomberg to just under 5 for every cent.

The darkening outlook has prevailed in markets, with stock benchmarks in mainland China and Hong Kong down about 5 and 4 per cent this 7 days, respectively. Even main companies in strategic sectors supported by Beijing have posted double-digit losses this 12 months, with chipmaker SMIC down 29 for each cent while CATL, the world’s greatest battery maker for electric motor vehicles, has fallen 35 for every cent.

“This will only get worse right before it gets improved,” stated Andy Maynard, a trader at investment financial institution China Renaissance. He included that while some hedge money ended up closing out bets towards Chinese stocks, “at higher amounts, there is enormous orders for the shorts to go again on again”.

Analysts stated the reality that China even experienced a expansion goal to skip this 12 months stemmed from original self esteem among the top rated leaders in their capacity to keep the stringent zero-Covid solution, which has been vocally endorsed by President Xi Jinping.

But the focus on was set prior to the hugely contagious Omicron coronavirus variant took maintain in China, ensuing in a series of lockdowns along with climbing mortality figures owing to a absence of vaccination among the vulnerable aged populations.

Now, as mass screening in Beijing stokes fears of a Shanghai-fashion lockdown, traders confront the prospect that the growth targets that have served as lodestar for the world’s 2nd-biggest economic climate for a quarter-century could no more time be achievable.

Analysts at JPMorgan wrote this week that their hottest forecast of 4.6 for each cent recommended China could “significantly” undershoot its advancement aim “for the initial time given that an annual focus on was introduced in the late 1990s”.

They also warned the People’s Bank of China may be holding back from large-scale stimulus on the assumption the qualified easing steps it has deployed would verify sufficient.

“If a policy selection is nonetheless based on historic analysis, the risk of policy under-delivery is substantial,” they stated.

Some institutional buyers have taken care of a positive outlook, even as anticipations deteriorate. On Tuesday, UBS World wide Wealth Administration mentioned it was reducing earnings growth forecasts for Chinese equities but however considered them as the greatest guess in the region.

“While market place sentiment is probably to be fragile in the around term, with earnings downgrades capping the performance of Chinese equities, we keep our most desired ranking for China within just our Asia portfolios and proceed to see regions of value,” reported Mark Haefele, main investment decision officer for the Swiss lender’s prosperity administration business enterprise.

But outflows from China’s stock market place recommend world investors are not prepared to hurry back in, with foreign holdings of onshore equities remaining down by about Rmb26bn ($4bn) for the calendar year to date, inspite of latest recommendations from regional officers that the depth of Shanghai’s lockdown had peaked.

“China’s Covid caseloads have moderated but all round sentiment has worsened further more,” reported Lu at Nomura, pointing to the latest stress getting at markets in Beijing. “We feel the worst is however to appear.”