China’s Kanzhun top industrial gainer, while airline stocks pile up losers’ list

Panuwat Dangsungnoen/iStock via Getty Images

Kanzhun took the top spot among gainers, continuing its see-saw trend, while airline stocks almost packed the entire list of decliners on concerns of fuel jet prices, among other things.

For the week ending June 3, The SPDR S&P 500 Trust ETF (SPY) was (+1.29%) in the green for the second week straight after a 7-week losing streak. However, YTD, the ETF is still in the red. The Industrial Select Sector SPDR (XLI) also gained (+2.41%) for the second week in a row, which preceded two back-to-back weeks of losses. YTD, XLI is -9.70%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +13% each. However, YTD, only two out of these five stocks are in the green.

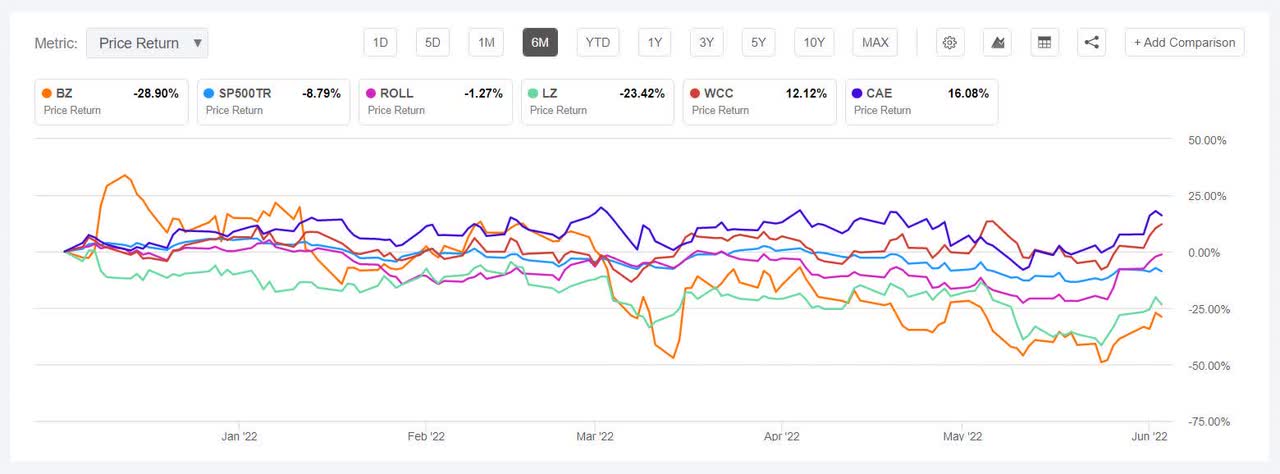

Kanzhun (NASDAQ:BZ) +21.78% continued to show its volatile nature as the stock was among the gainers this week. The Chinese online recruitment platform gained the most on June 2 (+10.88%). Certain China-based companies’ stock saw an uptick with the start of the month as lockdown restrictions began to be eased in some parts of China. However, Kanzhun stock has seen its ups and down for the past few months. It was among the decliners about a month ago, having made to the top just week prior to it. Similar trends were seen in March for the shares. YTD, the stock has fallen -38.13%, but the the Wall Street Analysts’ Rating is Buy with an Average Price Target of $37.91.

RBC Bearings (ROLL) +17.64%. The Oxford, Conn.-based company’s stock made it to the gainers’ list again, making it two in a row. Last week the stock got a boost from its earnings performance. The Wall Street Analysts’ Rating is Buy with an Average Price Target of $223.17. YTD, the stock is -1.42%.

LegalZoom.com (LZ) +15.13%. The Glendale, Calif.-based company, which provides an online platform for legal and compliance solutions, has seen its stock decline -14.75% YTD. SA contributor Daniel Jones wrote over a week ago, LegalZoom: Expect Continued Pressure. He said, “Near term, I fully suspect that this pressure will continue. But despite trading at a high multiple, I do think the firm makes for a valid ‘hold’ prospect at this time.

The chart below shows 6-month price-return performance of the top five gainers and SP500TR:

WESCO International (WCC) +13.59% The Pittsburgh-based provider of logistics and supply chain solutions, is the only company, besides CAE, among the the top gainers of this week whose stock is in the green. YTD, the stock has risen +5.34%. The SA Quant Rating on the stock is a Strong Buy.

CAE (CAE) +13.34%. The stock rose the most on the day (June 1 +7.69%) following its Q4 results on May 31 post market. The Canadian company, which provides flight simulation equipment and training solutions, saw its revenue grow ~7% Y/Y to C$955M. YTD, the shares have risen +6.70%.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -3% each. YTD, all these stocks, barring UAL, are in the red.

Airline stocks fell in unison on June 1 as optimism on summer travel demand was overshadowed by rising jet fuel prices and lingering labor shortages.

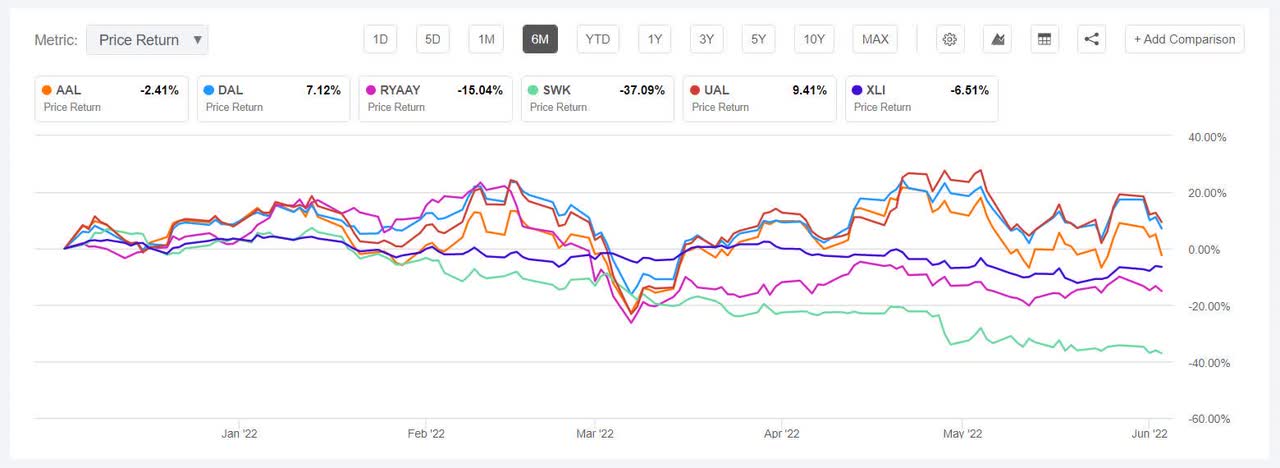

American Airlines (NASDAQ:AAL) -5.92%. At the end of the week (June 3) the stock dipped again. AAL said it saw an increase Q2 revenue compared to Q2’19 but narrowed its Capacity guidance. YTD, the stock has declined -9.69%.

Delta Air Lines (DAL) -5.61%. The stock declined the most on June 1 (-6.23%). Separately, Delta CEO Ed Bastian said that the company is trying to reach a deal with Boeing for 737 MAX jets. YTD, the stock is -1.38% but the Wall Street Analysts’ Rating is Strong Buy with an Average Price Target $54.95%.

Ryanair (RYAAY) -3.99%. Ireland-based airlines said on June 2 that May traffic grew 8% sequentially causing a slight uptick in the stock that day, which for the rest of the week was in the red. YTD, the stock has shed -16.50%.

The chart below shows 6-month price-return performance of the worst five decliners and XLI:

Stanley Black & Decker (SWK) -3.92%. The New Britain, Conn.-based company’s stock fell the most on June 1 (-3.36%) after it reported the promotion of its CFO to CEO role and reaffirmed its FY22 outlook. Baird, however, noted that the company was attractive despite the shakeup in its executive ranks. YTD, the stock has fallen -39.28%, the most among this week’s five losers. The SA Quant Rating is Sell on the stock.

United Airlines (UAL) -3.56% wrapped up the five worst decliners for the week, and market the fourth airline in the list. However, YTD, it is the only stock among these five which is still in the green +1.48%. The Wall Street Analysts’ Rating is Buy with an Average Price Target of $60.88.