An Incredible Stock Market Money-Making Opportunity Is Fast Approaching

It is been a wild yr for stocks, huh? There’s a large amount of concern swirling in the inventory sector, not least of which is a looming recession. But what if I informed you all this volatility is making the funds-building option of the century?

Resource: Zakharchuk / Shutterstock

You’d glimpse at me funny, very skeptical. And which is fantastic. Just do not disregard it — simply because I have ton of facts to show that claim. Currently we’re on the cusp of the most significant expense option in the stock market… at any time.

Yes, I’m informed of all the troubles the earth is struggling with currently. There is a long time-large inflation and a U.S. Federal Reserve that’s embarking on the most aggressive tightening route since the 1970s. A war in Europe has started for the initially time considering that Entire world War II. The highest fuel and grocery rates are hitting us sq. in the wallet. There are far more Covid-19 lockdowns in China, and the inventory market’s experienced its worst begin to a yr considering the fact that 1942.

Speak about abnormal. Chat about volatility. It is downright terrifying.

In opposition to that backdrop, I wouldn’t blame you for seeking to operate for the hills and take deal with from the storm. But the terrific Warren Buffett after mentioned that it is normally finest to be greedy when other individuals are fearful.

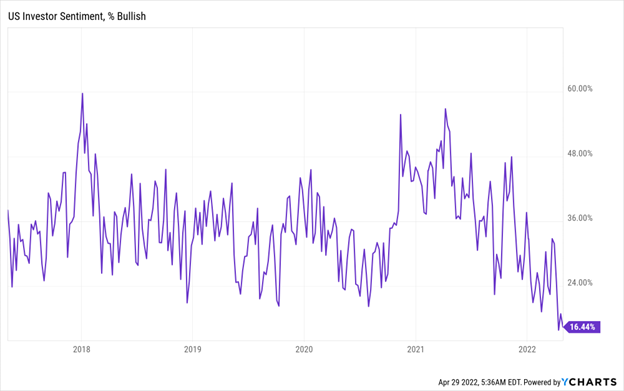

And everyone’s fearful appropriate now. The percentage of bullish unique U.S. traders sits at 16.4% today. Which is its most affordable looking through due to the fact 1992. It indicates buyers are significantly less bullish these days than through the Covid-19 pandemic, monetary crisis of 2008 and the dot-com crash. Allow that sink in for a instant.

There’s nothing but fear out there. And Buffett would explain to us to get greedy in this article. Need to we heed these words and phrases of tips?

Absolutely.

The Ultra-Unusual Inventory Industry Phenomenon

More than the past a number of months, my staff and I have researched the intricacies of inventory market crashes throughout modern day history. And we uncovered a little something astounding.

Especially, we’ve learned an ultra-uncommon inventory market phenomenon that takes place about after each and every 10 years. And it consistently delivers the finest purchasing chances in the record of the U.S. stock sector.

Furthermore, we’ve figured out how to quantitatively discover this anomaly. Greater but, we have engineered a way to ideal take gain of it to rake in substantial earnings.

Well, individuals, guess what is taking place right now?

This ultra-exceptional current market phenomenon is emerging correct now. And our versions are flashing dazzling “buy” signals as the window of opportunity to capitalize on it is rapidly approaching.

I know. That may possibly audio counterintuitive, provided what is going in the markets correct now.

But I’m staking my career on this claim — due to the fact it is not an belief. It is a actuality backed by details, history, stats and arithmetic. It’s backed by the major market place phenomenon in historical past.

So, I repeat: We stand on the cusp of an option of a lifetime.

By now, you are likely considering, Ok, Luke, you have my consideration. But where’s this evidence?

I’m happy you requested mainly because I have a lot of that. Let’s choose a deep seem.

Inventory Rates Adhere to Fundamentals

To realize the one of a kind incidence my group and I have determined, we want to 1st acknowledge stocks’ actions pattern.

In the short-phrase, shares are pushed by a myriad of aspects, like geopolitics, desire premiums, inflation, elections, recession fears. The checklist goes on.

Even so, in the lengthy-expression, shares are pushed by a single point and a person point only: fundamentals.

At the stop of the working day, revenues and earnings push inventory costs. If individuals fundamentals craze upward over time, then a company’s stock price will comply with go well with and rise. Conversely, if revenues and earnings craze downward, then the inventory value will drop.

That may possibly seem like an oversimplification. But, honestly, it is not.

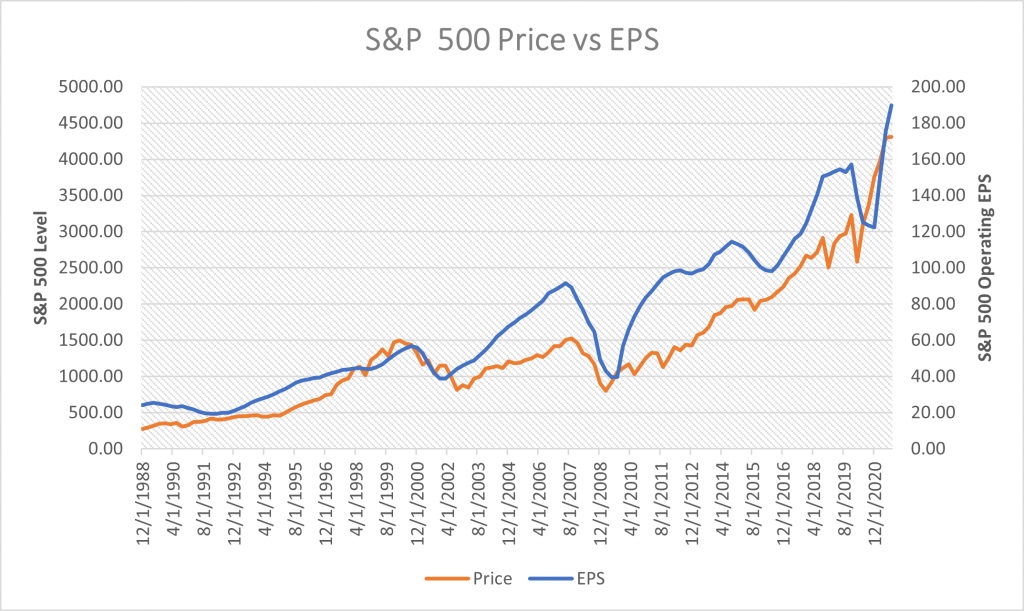

Just glimpse at the subsequent chart. It graphs the earnings for each share of the S&P 500 (blue) along with the stock price tag (orange) from 1988 to 2022.

As you can see, the blue line (earnings for every share) lines up just about correctly with the orange (price). The two could not be much more strongly correlated. Without a doubt, the mathematical correlation concerning them is .93. Which is very strong. A perfect correlation is one. And a perfect anti-correlation is negative one.

For that reason, the correlation amongst earnings and inventory price ranges is about as flawlessly correlated as anything at all gets in the real environment.

In other text, you can neglect the Fed. You can forget inflation. You can forget about geopolitics, trade wars, recessions, depressions and monetary crises.

We’ve found all that over the earlier 35 years. And by means of it all, the correlation concerning earnings and inventory price ranges never broke or even faltered at all.

At the conclusion of the working day, earnings travel stock charges. History is crystal clear on that. In truth, mathematically speaking, heritage is as very clear on that as it is on something.

Great Divergences Build Fantastic Opportunities

The phenomenon my staff and I have recognized has to do with this correlation. In simple fact, it has to do with a “break” in this correlation.

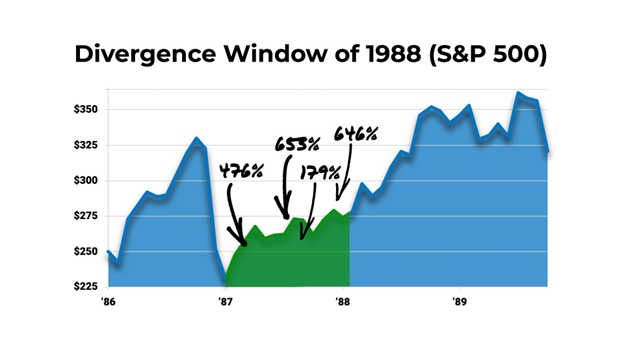

Every single when in a when — about when a decade — a unusual anomaly emerges in the stock sector there earnings and revenues briefly halt driving inventory price ranges.

We simply call this a “divergence.”

For the duration of these occurrences, firms see revenues and earnings rise, yet inventory selling prices briefly collapse because of to macroeconomic fears. The final result is that a company’s stock cost diverges from its basic expansion trend.

Every time these unusual divergences emerge, they turn into generational purchasing possibilities whereby inventory charges snap back again to fundamental growth developments.

This has happened time and once more all through the background of the marketplaces.

It took place in the late 1980s for the duration of the Cost savings and Personal loan disaster. Large-quality advancement corporations like Microsoft (MSFT) observed inventory costs collapse though revenues and earnings stored climbing. Buyers who capitalized on this divergence doubled their income in a year. And on average, they scored a jaw-dropping ~40,000% returns in the very long operate.

It occurred again in the early 2000s right after the dot-com crash. Higher-good quality advancement businesses like Amazon (AMZN) noticed stock charges plunge in the crash. But revenues and earnings retained growing. Investors who capitalized on this divergence a lot more than doubled their revenue in a 12 months. And they scored much more than 20,000% returns in the long expression.

And it transpired for the duration of the money disaster of 2008. Substantial-quality expansion firms like Salesforce (CRM) saw inventory costs collapse, although revenues and earnings stored climbing. Investors who capitalized on this divergence almost tripled their income in calendar year and strike 10X returns in just 5 several years.

This is the most profitable repeating sample in inventory market place heritage. And it’s taking place all over again now for the initial time in 14 years.

Volatility Makes Possibility

Market place volatility generally results in sector chance.

So, above the earlier six months of the market’s wild gyrations, we’ve made it our precedence to exploration this volatility. We sought to create a stock-choosing technique to make tons of income in unpredictable markets.

That led us to producing the biggest discovery in InvestorPlace record: the existence of uncommon divergence home windows.

These windows only appear about the moment a 10 years amid peak industry volatility. They open up for really transient times in time — and only in selected stocks. But if you capitalize on them by acquiring the correct stocks at the appropriate second, you can make enormous gains. And you can do that though everybody else is having difficulties to survive in a choppy market.

Without a doubt, these divergence windows give you a serious shot at turning $10,000 investments into multi-million-greenback paydays.

The far more we investigated these divergences, the additional fired up we turned.

And then we designed the most important discovery of them all: A model-new divergence is forming suitable now.

Last Phrase on the Biggest Inventory Sector Phenomenon

Our types show this is the biggest divergence at any time. That signifies the likely profits to be produced from it are going to be the biggest at any time, way too.

But timing is of the essence listed here.

The massive multi-thousand-p.c gains created during past divergences ended up only achievable if you bought the suitable shares at accurately the proper time.

And it is just not just the ideal time yet…

But our types are indicating that it could be any instant now. In simple fact, as I create this, our versions are transferring at any time nearer to flashing the perfect “buy” signal.

So, to retain you up to date, we have began a Divergence 2022 Enjoy listing.

We remarkably advise you sign up for it currently. Right after you do, I’ll ship you all the information and facts I have on these divergences. I’ll exhibit you all the charts and the information. I’ll really plainly illustrate the opportunity in this article.

Most importantly, you are going to be set on a VIP record. And as before long as our designs explain to us the divergence window has opened, you’ll be the 1st to listen to!

Once more, that could come about any day now. And when it does, you’ll be introduced with the rarest possibility to rating massive returns in stock market place record.

This is the most psyched I have ever been in my profession. We’re times absent from remaining offered the fiscal chance of a life time.

Get in on this incoming wave of prosperity, and I’ll make sure you do not overlook it.

On the date of publication, Luke Lango did not have (possibly immediately or indirectly) any positions in the securities stated in this article.